Post Office GAG Policy Online Apply Details Life Insurance

Do you mean Post Office GAG Policy as in Gramin Dak Jeevan Bima (Rural Postal Life Insurance) Policy?

Because India Post offers PLI (Postal Life Insurance) and RPLI (Rural Postal Life Insurance), and under RPLI, there is a scheme called Gram Suraksha / Gramin policies, which many people call GAG policy in short.

If yes, here are the Post Office GAG (Gramin) Policy Online Apply Details in a blog-post style (around 600 words):

Post Office GAG Policy Online Apply Details

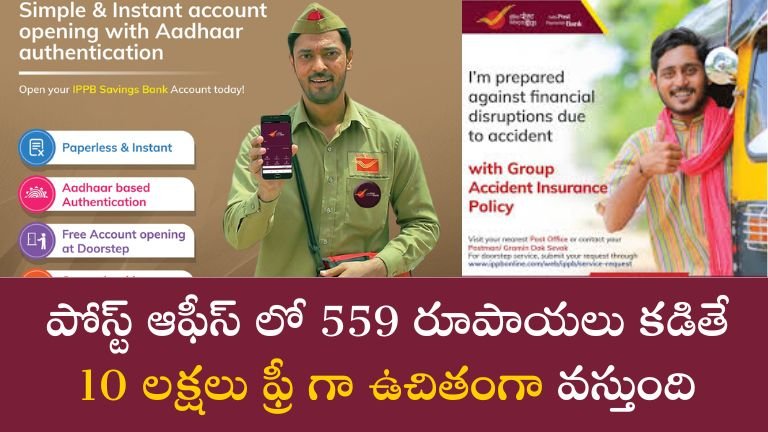

The Department of Posts, under the Ministry of Communications, offers affordable and reliable insurance services through Postal Life Insurance (PLI) and Rural Postal Life Insurance (RPLI). Among these, the Gramin (GAG) Policy has been designed especially for rural people, ensuring financial protection and security at low premium rates. It is one of the most trusted insurance options for farmers, labourers, and people living in villages who may not have access to private insurance companies.

With the introduction of online facilities by India Post, now people can apply for Post Office GAG Policy online, making the process faster and more convenient.

Key Features of Post Office GAG Policy

-

Affordable Premiums – Designed to be budget-friendly for rural households.

-

Wide Coverage – Provides financial protection to policyholders’ families in case of death.

-

Flexibility – Premiums can be paid monthly, quarterly, half-yearly, or annually.

-

Loan Facility – After a few years, policyholders can also take a loan against their policy.

-

Tax Benefits – Premium payments are eligible for deductions under Income Tax Act.

-

Reliable & Safe – Directly managed by the Government of India through India Post.

Eligibility for GAG Policy

-

Any rural resident of India between 19 years to 55 years can apply.

-

The person must provide valid KYC documents such as Aadhaar card, Voter ID, PAN, etc.

-

Policy term may vary from 10 years to 35 years depending on the applicant’s age.

Required Documents

When applying for a Post Office Gramin (GAG) Policy, you need:

-

Aadhaar Card / Voter ID / Driving License (as ID proof)

-

Proof of Address (Ration Card / Aadhaar / Electricity Bill)

-

Passport-size photographs

-

Income proof (if required)

-

Duly filled application form

How to Apply for Post Office GAG Policy Online

The Post Office has made it easier for customers to apply online. Here is the step-by-step guide:

-

Visit the Official Website

-

Go to the India Post Life Insurance official portal: https://pli.indiapost.gov.in

-

-

Register / Login

-

New users must register by entering policy details and mobile number.

-

Existing users can log in using their Customer ID and password.

-

-

Select Rural Postal Life Insurance (RPLI)

-

Under the available products, choose the Gramin (GAG) Policy option.

-

-

Fill Online Application Form

-

Provide personal details, nominee details, and preferred policy term.

-

-

Upload Documents

-

Upload scanned copies of Aadhaar, PAN, photograph, and proof of address.

-

-

Pay Premium Online

-

First premium payment can be made through debit card, credit card, or net banking.

-

-

Confirmation

-

Once payment is successful, you will get an acknowledgment receipt and policy number on your registered mobile/email.

-

Offline Application (Optional)

Those who are not comfortable with online mode can also apply offline by visiting their nearest Post Office branch. The staff will help fill out the form, verify documents, and process the application.

Premium Payment Options

Policyholders can pay premiums:

-

Online via India Post Payment Bank (IPPB) App

-

Through Post Office counters

-

Using PLI/RPLI online portal

Automatic reminders are also sent to policyholders to avoid policy lapse.

Why Choose Post Office GAG Policy?

-

Backed by the Government of India

-

Lower premium rates compared to private companies

-

Covers rural and semi-urban populations

-

Simple claim settlement procedure through Post Office

-

Lifelong trust and reliability of India Post

Conclusion

The Post Office GAG Policy is a strong financial safety net for rural families in India. By offering affordable premiums, tax benefits, and secure coverage, it ensures peace of mind for lakhs of people. With the online application facility, customers can now apply easily without visiting the Post Office multiple times.

If you are looking for a safe, reliable, and government-backed insurance plan, the Post Office GAG Policy is an ideal choice.